To be a reminder, your employer founded a retirement savings want to empower and really encourage you to avoid wasting for retirement. Although the plan may contain an in-provider withdrawal or loan provision, Mutual of America won't stimulate participants to soak up-support withdrawals or loans, and also your strategy discounts aren't meant to be useful for latest bills. When accessible, in-company withdrawals are normally taxed as ordinary profits (and may be assessed a ten% tax penalty if taken before age 59½, or for easy IRA withdrawals, a 25% tax penalty if taken ahead of age fifty nine½ and within the 1st two many years of participation).

Conversely, you should incorporate some lacking circumstances in the first sort. Our Innovative document editing equipment are The ultimate way to take care of and change the document.

The worker can avoid the fast income tax repercussions by rolling over all or Section of the loan’s superb balance to an IRA or qualified retirement system from the because of date (which include extensions) for submitting the Federal money tax return for your yr where the loan is addressed as being a distribution. This rollover is documented on Kind 5498.

All investments carry threat, and no investment strategy can guarantee a gain or guard from loss of capital.

In the following paragraphs, We will be reviewing the 403(b) contribution principles that have the greatest influence on a approach's contributors. That dialogue will probably incorporate elective deferrals, soon after-tax contributions, maximum allowable contributions, along with the fifteen-12 months Rule. You will discover only two sources of money which might be directed to the 403(b) account: a wage reduction agreement, or an employer making contributions straight to the fund by itself.

Most designs permit you to borrow 50% of the account’s vested harmony, nearly a maximum of $50,000. Not all ideas will let you borrow out of your vested organization match. Some strategies only make it possible for that you should borrow from a vested contributions.

When a program is in position, you’ll pay out equal payments above the phrase in the loan. The payments will come out of one's paycheck.

Therefore that you are paying out again the loan with right after-tax revenue. These phrases are Usually non-negotiable when the loan is granted. Having said that, several plans will enable you to pay back the loan in a lump sum Should you be equipped.

Prior to deciding to initiate a withdrawal or rollover from an employer-sponsored retirement prepare that is certainly matter to spousal consent and is also funded by a group annuity deal, you should full the following ways:

Even though there's no real Internet desire Price since you're having to pay your self the curiosity, there is nonetheless a true Expense to having the loan from the financial savings -- the returns you would get from maintaining the cash invested.

The 403(b) loan has to be repaid in equivalent installments a minimum of quarterly or even more frequently. The loan repayment period of time is often 5 years, but it might be for a longer period For anyone who is borrowing to purchase a dwelling.

The knowledge contained on this Web-site is not intended as, and shall not be understood or construed as, tax guidance. It's not at all a substitute for tax assistance from knowledgeable.

Payments within the loan has to be made quarterly (in a minimum). The loan settlement could provide for a three-thirty day period grace period, and could also let a participant to suspend payments throughout military check here services support.

Expertise a speedier method to complete and indication forms on the net. Obtain essentially the most considerable library of templates obtainable.

Ariana Richards Then & Now!

Ariana Richards Then & Now! Jonathan Lipnicki Then & Now!

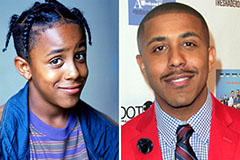

Jonathan Lipnicki Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Loni Anderson Then & Now!

Loni Anderson Then & Now!